The Sindh Government has introduced an interest-free loan program for poor students in the province. This initiative aims to support students studying at the Agricultural University in Tando Jam by offering loans with no interest, low-interest rates, and flexible repayment options.

The university’s Department of Agriculture will oversee the process, ensuring that loans are distributed efficiently to the students. This program is designed to help students who face financial difficulties and want to start their own businesses after graduation. The Sindh Government hopes to encourage these entrepreneurial students by providing the financial support they need to succeed.

Contents

Student Interest-Free Loan Scheme

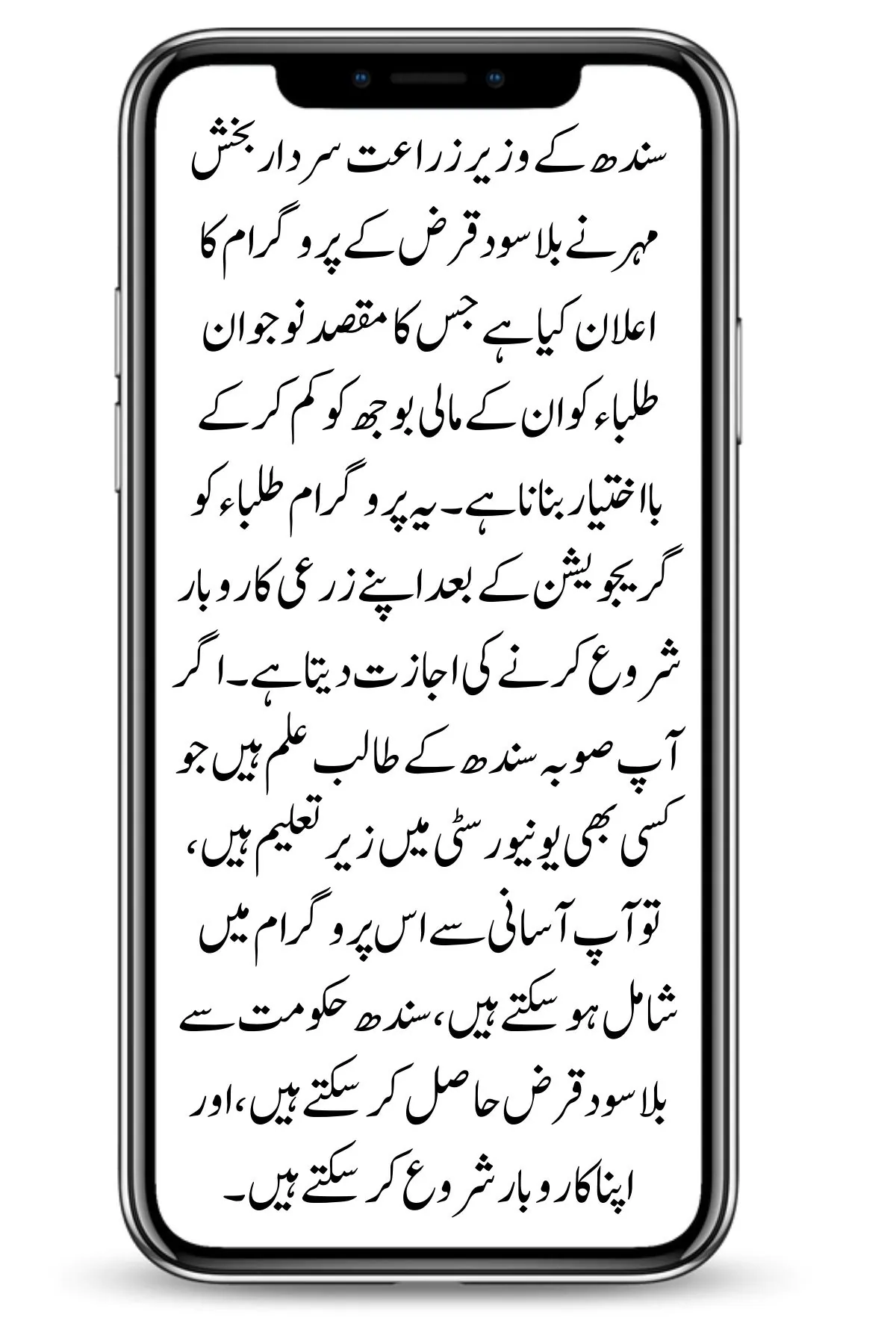

Sindh Agriculture Minister Sardar Bakhsh Mehr has announced an interest-free loan program aimed at empowering young students by reducing their financial burden. This program allows students to start their own agricultural businesses after graduation. If you are a student from Sindh province studying at any university, you can easily join this program, get an interest-free loan from the Sindh government, and start your own business.

Minister Sardar Bakhsh Mehr has provided a golden opportunity for students who want to launch their own agricultural businesses after graduation. This article will guide you through the entire process, from applying to receiving the loan. Read carefully to learn how to become a part of the interest-free loan program established by the Government of Sindh.

Eligibility Criteria for the Interest-Free Loan Scheme

To register for the interest-free loan scheme created by the Sindh government, you must meet the following eligibility criteria. This scheme is only available to students in Sindh province.

- Students must be studying in public sector universities or colleges recognized by HEC.

- All students must have higher education than graduation.

- Students must be under 21 years old for graduation.

- For post-graduation, students must be under 31 years old.

- PhD students must be under 36 years old.

- A minimum score of 70% in the final public examination is required.

- Students must prove their financial inability and come from a poor family.

You may also read: How to Check Your BISP Payment Using the Latest Method in 2024

How to Apply for the Interest-Free Loan Scheme

| Category | Details |

| Program Name | Interest-Free Loan Program for Students in Sindh 2024 |

| Introduced By | Sindh Government |

| Purpose | To support poor students at the Agricultural University in Tando Jam by offering interest-free loans, low-interest rates, and flexible repayment options. |

| Target Group | Poor students in Sindh province |

| Administering Body | University’s Department of Agriculture |

| Primary Benefit | Financial support for students to start their own businesses after graduation |

| Announced By | Sindh Agriculture Minister Sardar Bakhsh Mehr |

| Key Goal | Empowering students to launch agricultural businesses and promoting sustainable agricultural practices |

If you are a poor student who has completed your graduation and wants to apply for the Sindh Government Students Loan Scheme, here is the complete method to ensure your registration:

Obtain the registration form from your university to become part of this scheme.

Alternatively, you can apply for the student loan scheme by visiting the Bank of Punjab.

After joining the program, you will be informed whether you are eligible for the loan or not.

Conclusion

The Sindh government’s interest-free loan initiative for students at the Agricultural University, Tando Jam, aims to reduce financial stress and help students start new agribusinesses. The University’s Department of Agriculture will ensure efficient loan distribution.

Minister Sardar Bux Mehr emphasized the role of educated and innovative individuals in addressing the impact of climate change on agriculture and promoting sustainable practices. Additionally, the upcoming Green Card project will further support the agricultural community by offering various benefits and resources to farmers across the region.

Also Read: Himat Card 7500 Payment: Complete Registration Process for 2024

FAQs:

What is the Interest-Free Loan Program introduced by the Sindh Government?

A financial support initiative offering interest-free loans to poor students at the Agricultural University in Tando Jam.

Who is eligible for the Interest-Free Loan Scheme?

Students in public sector universities, under age limits, with a minimum 70% score, proving financial need.

How can students apply for the Interest-Free Loan Scheme?

By obtaining the registration form from their university or the Bank of Punjab.

What is the purpose of the Interest-Free Loan Program?

To empower students to start agricultural businesses by reducing financial burdens.

What role does the University’s Department of Agriculture play in this program?

Overseeing loan distribution to eligible students for agribusiness ventures.